Pricing Asian Options in Affine Garch models Lorenzo Mercuri Dip. Metodi Quantitativi per le Scienze Economiche e Aziendali Milano-Bicocca th of. - ppt download

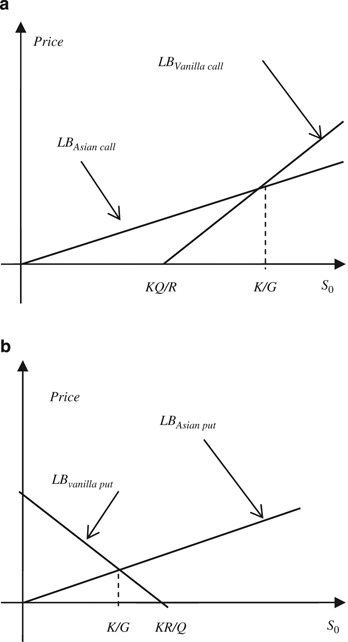

Comparison of xed strike Asian call option with barrier on asset price... | Download Scientific Diagram

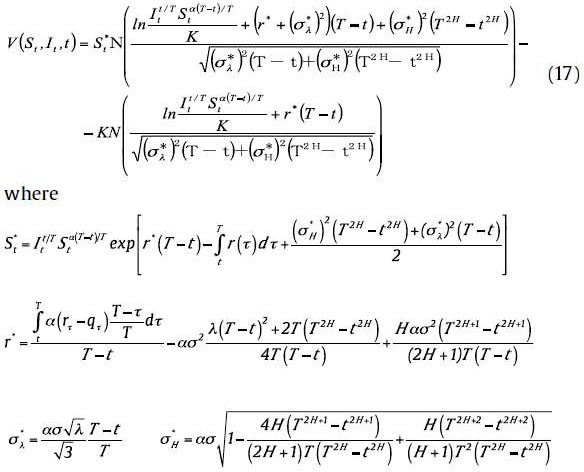

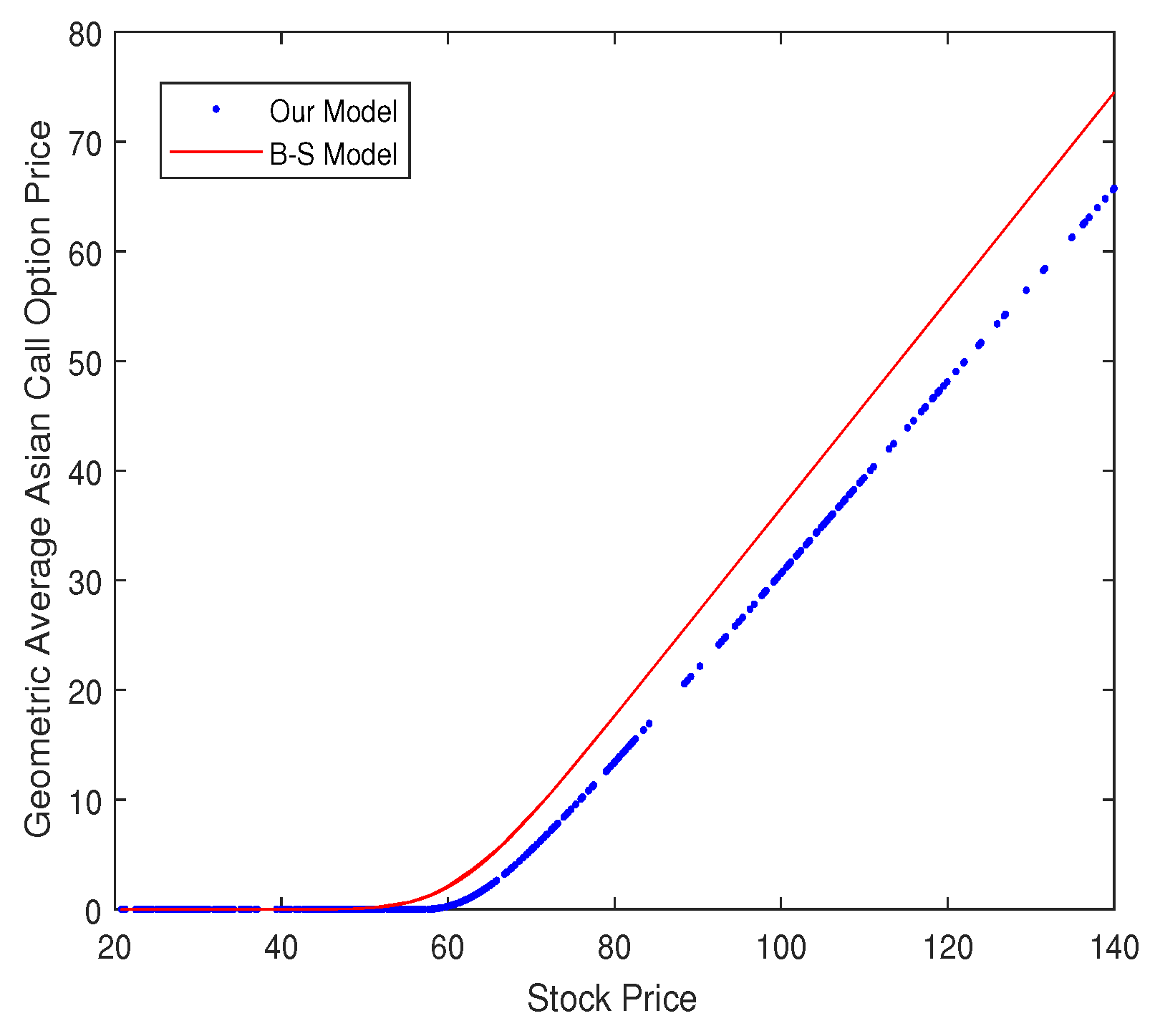

Entropy | Free Full-Text | Geometric Average Asian Option Pricing with Paying Dividend Yield under Non-Extensive Statistical Mechanics for Time-Varying Model

PDF) A PDE approach to Asian options: analytical and numerical evidence* 1 | Dyakopu Neliswa - Academia.edu

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

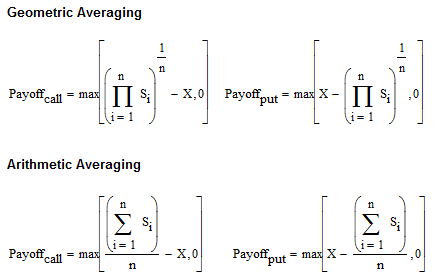

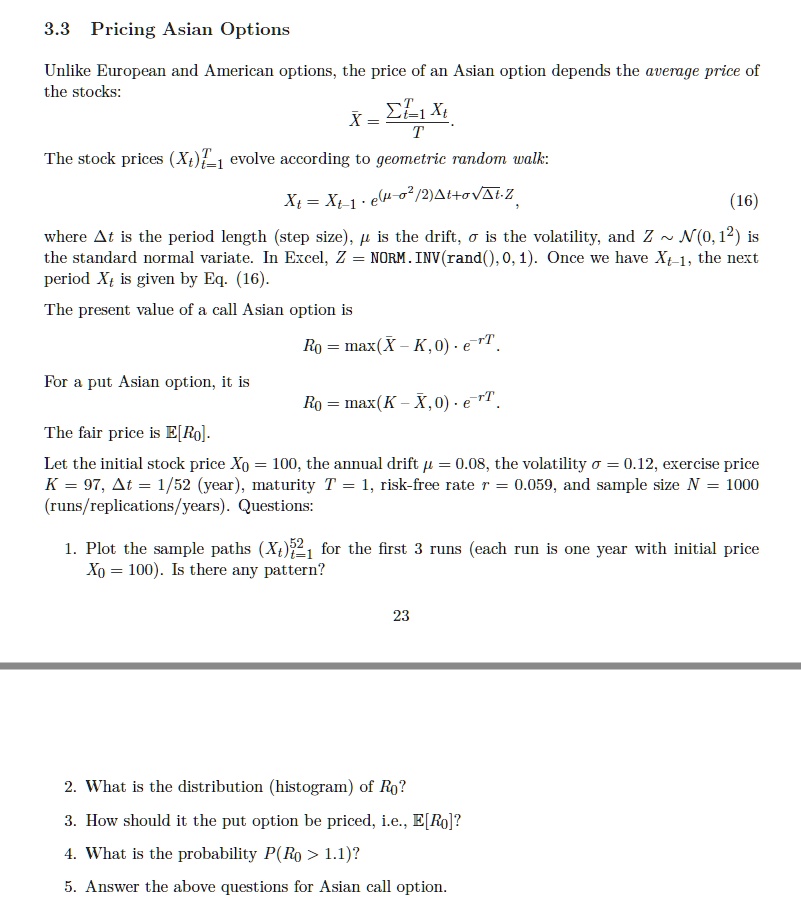

SOLVED: 3.3 Pricing Asian Options Unlike European and American options the price of an Asian option depends the average price of the stocks: X = Ek The stock prices (Xt)?-1 evolve according

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com