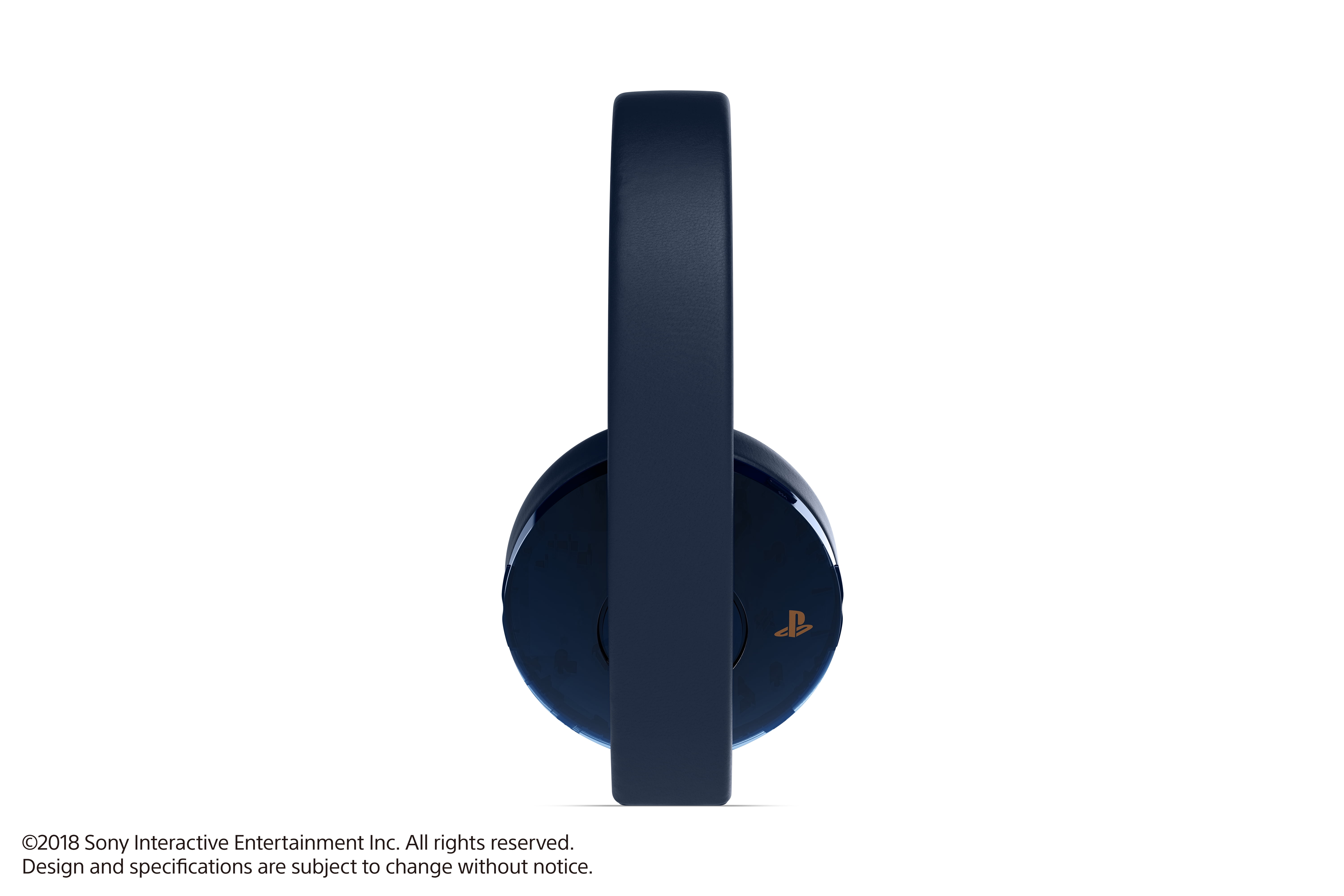

Sony -Playstation 4 Wireless Stereo Headset Gold 500 Million Limited Edition navy blue -Sony Accessories Grooves.land/Playthek

SONY PlayStation 4 Gold Wireless Headset 500 Million Limited Edition - – J&L Video Games New York City

![Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games](https://m.media-amazon.com/images/I/71Fr6Uj2APL.jpg)

Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games

PlayStation 4 Pro 500 Million Limited Edition Accessories Bundle: PlayStation 4 Pro 4K HDR 1TB Console - Jet Black with Extra 500 Million Limited Edition Gold Wireless Headset and Controller - Walmart.com

Playstation Gold Wireless Headset for PS4 Review & Sound Test - 500 Million Limited Edition (Part 2) - YouTube

![Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games](https://m.media-amazon.com/images/I/61gcJX5dNTL._AC_UF1000,1000_QL80_.jpg)

Amazon.com: PlayStation Gold Wireless Headset 500 Million Limited Edition - PlayStation 4 [Discontinued] : Video Games

DataBlitz - CELEBRATE A MILESTONE! Re-Stock: Sony PS4 Gold Wireless Headset 500 Million Limited Edition will be available today at Datablitz! In the world of PlayStation, the possibilities of play are endless.

Ps4 Playstation 4 Platinum Wireless Headset | Playstation 4 Headphones Accessories - Earphones & Headphones - Aliexpress