Arifureta: From Commonplace to World's Strongest (Manga) Vol. 1 : Shirakome, Ryo: Foreign Language Books - Amazon.co.jp

Arifureta: From Commonplace to World's Strongest Light Novel Vol. 6 by Ryo Shirakome, Paperback | Barnes & Noble®

Amazon.com: Arifureta: From Commonplace to World's Strongest (Light Novel) Vol. 1: 9781626927681: Shirakome, Ryo: Books

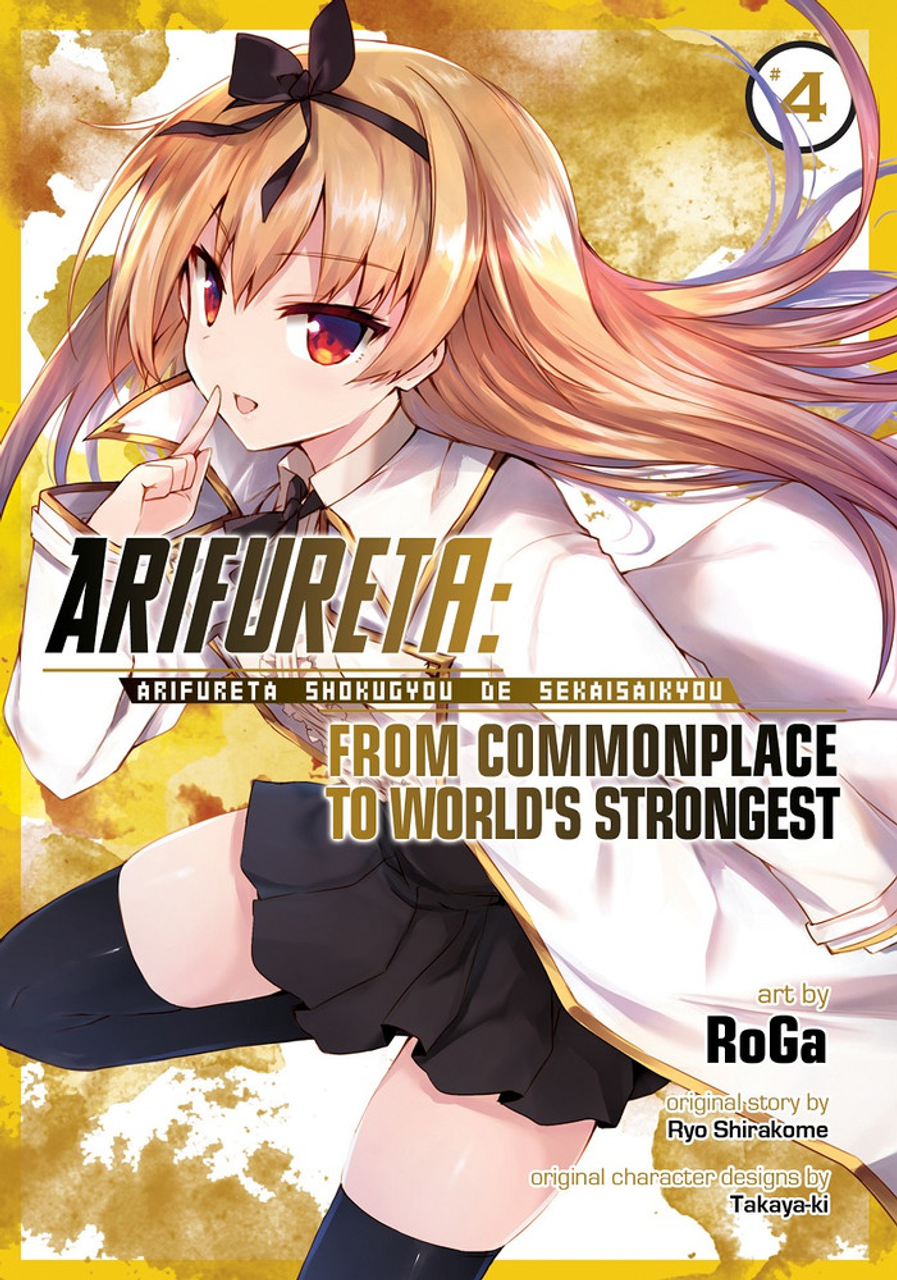

![Amazon | Arifureta: From Commonplace to World's Strongest: Volume 4 (English Edition) [Kindle edition] by Shirakome, Ryo, Takayaki, Ningen | Fantasy | Kindleストア Amazon | Arifureta: From Commonplace to World's Strongest: Volume 4 (English Edition) [Kindle edition] by Shirakome, Ryo, Takayaki, Ningen | Fantasy | Kindleストア](https://m.media-amazon.com/images/I/510sIThCn+L.jpg)

Amazon | Arifureta: From Commonplace to World's Strongest: Volume 4 (English Edition) [Kindle edition] by Shirakome, Ryo, Takayaki, Ningen | Fantasy | Kindleストア

Arifureta From Commonplace to World's Strongest Zero Vol. 4 (Manga) - Entertainment Hobby Shop Jungle

Arifureta: From Commonplace to World's Strongest (Light Novel) Vol. 12: 9781648279294: Shirakome, Ryo, Takaya-Ki: Books - Amazon.com

Amazon.com: Arifureta: From Commonplace to World's Strongest (Light Novel) Vol. 5: 9781642750171: Shirakome, Ryo: Books

Amazon.com: Arifureta: From Commonplace to World's Strongest (Light Novel) Vol. 1: 9781626927681: Shirakome, Ryo: Books

Arifureta - From Commonplace to World's Strongest Light Novels End in Next Volume - News - Anime News Network

Arifureta - From Commonplace to World's Strongest OVA Reveals Title, Visual, September 25 Release - News - Anime News Network